All Categories

Featured

Table of Contents

If you select degree term life insurance, you can budget plan for your costs since they'll remain the same throughout your term. And also, you'll recognize precisely just how much of a death advantage your beneficiaries will certainly get if you pass away, as this quantity won't change either. The rates for degree term life insurance will certainly depend on numerous factors, like your age, wellness standing, and the insurance provider you choose.

Once you go via the application and medical examination, the life insurance policy firm will review your application. Upon approval, you can pay your first costs and authorize any appropriate documentation to ensure you're covered.

Aflac's term life insurance policy is convenient. You can select a 10, 20, or three decades term and appreciate the included satisfaction you are entitled to. Working with a representative can aid you locate a policy that functions ideal for your demands. Discover much more and obtain a quote today!.

As you try to find ways to protect your economic future, you have actually likely come throughout a wide array of life insurance choices. term vs universal life insurance. Picking the right coverage is a huge decision. You want to find something that will aid support your loved ones or the causes crucial to you if something occurs to you

Many individuals favor term life insurance policy for its simpleness and cost-effectiveness. Term insurance policy agreements are for a fairly short, specified amount of time yet have alternatives you can customize to your demands. Particular benefit alternatives can make your costs transform with time. Level term insurance policy, however, is a sort of term life insurance policy that has constant payments and a changeless.

Family Protection What Is Direct Term Life Insurance

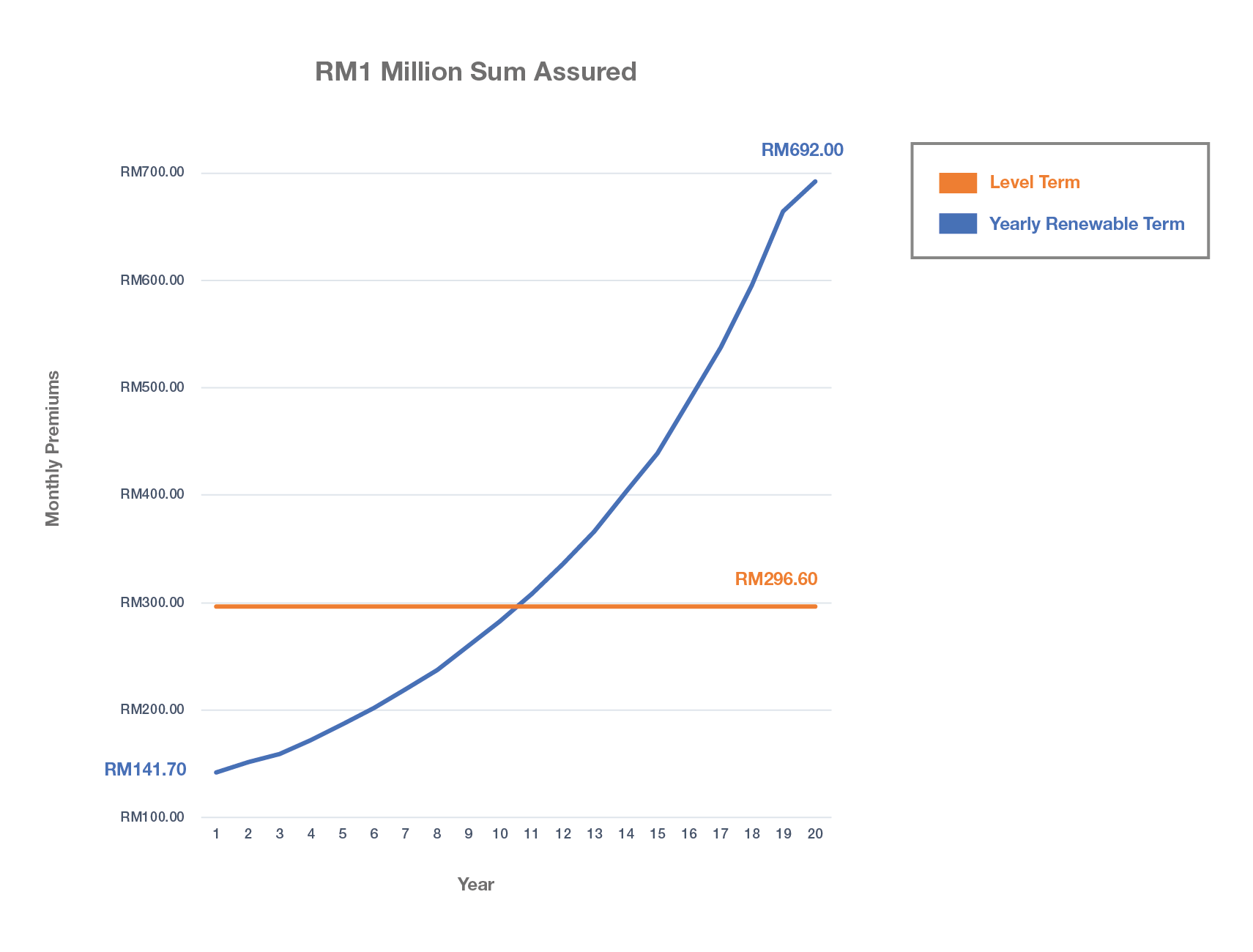

Degree term life insurance policy is a part of It's called "level" since your premiums and the advantage to be paid to your loved ones continue to be the exact same throughout the contract. You won't see any type of modifications in expense or be left questioning its worth. Some contracts, such as every year sustainable term, may be structured with costs that increase over time as the insured ages.

Fixed fatality advantage. This is also established at the start, so you can understand specifically what fatality benefit amount your can anticipate when you pass away, as long as you're covered and current on costs.

You agree to a fixed costs and fatality advantage for the period of the term. If you pass away while covered, your fatality advantage will be paid out to loved ones (as long as your costs are up to day).

You might have the option to for one more term or, more probable, restore it year to year. If your agreement has an assured renewability stipulation, you may not need to have a brand-new clinical examination to maintain your insurance coverage going. Nevertheless, your premiums are likely to boost since they'll be based on your age at renewal time (level term life insurance definition).

With this alternative, you can that will certainly last the rest of your life. In this case, once again, you may not need to have any kind of new medical tests, however costs likely will climb as a result of your age and new insurance coverage. term life insurance with accidental death benefit. Various companies use various choices for conversion, make sure to understand your options prior to taking this step

Preferred Level Term Life Insurance Meaning

Speaking to a financial expert also might aid you establish the path that straightens best with your total technique. Most term life insurance policy is level term for the duration of the agreement duration, yet not all. Some term insurance policy may come with a premium that raises in time. With lowering term life insurance, your survivor benefit drops gradually (this kind is typically obtained to particularly cover a lasting debt you're settling).

And if you're established up for renewable term life, after that your costs likely will increase each year. If you're checking out term life insurance policy and wish to make sure straightforward and foreseeable financial defense for your family members, level term might be something to consider. Nevertheless, as with any kind of sort of protection, it may have some constraints that do not meet your demands.

Sought-After Level Premium Term Life Insurance Policies

Typically, term life insurance is more economical than long-term protection, so it's an economical means to safeguard financial security. At the end of your contract's term, you have several choices to continue or move on from protection, often without requiring a medical test.

As with other kinds of term life insurance coverage, once the contract ends, you'll likely pay greater costs for insurance coverage because it will recalculate at your existing age and wellness. If your economic circumstance changes, you might not have the required coverage and might have to purchase extra insurance.

But that doesn't mean it's a suitable for every person. As you're looking for life insurance policy, here are a few essential factors to consider: Spending plan. Among the advantages of level term protection is you recognize the price and the death advantage upfront, making it much easier to without stressing over increases with time.

Age and health. Usually, with life insurance policy, the healthier and more youthful you are, the much more affordable the insurance coverage. If you're young and healthy and balanced, it might be an enticing alternative to lock in reduced costs currently. Financial duty. Your dependents and economic duty play a duty in determining your protection. If you have a young household, for circumstances, level term can assist provide economic support throughout essential years without spending for protection much longer than necessary.

1 All riders are subject to the terms and problems of the cyclist. Some states may differ the terms and conditions.

2 A conversion credit history is not offered for TermOne plans. 3 See Term Conversions area of the Term Collection 160 Product Overview for just how the term conversion credit rating is identified. A conversion credit scores is not offered if premiums or fees for the brand-new policy will be waived under the regards to a rider offering special needs waiver advantages.

Reputable A Term Life Insurance Policy Matures

Term Collection products are released by Equitable Financial Life Insurance Policy Company (Equitable Financial) (NY, NY) and are co-distributed by Equitable Network, LLC (Equitable Network Insurance Coverage Company of The Golden State, LLC in CA; Equitable Network Insurance Policy Company of Utah in UT; and Equitable Network of Puerto Rico, Inc. Term Life Insurance is a kind of life insurance policy that covers the policyholder for a specific quantity of time, which is understood as the term. Terms commonly range from 10 to 30 years and increase in 5-year increments, offering degree term insurance.

Latest Posts

National Seniors Insurance Funeral Plan

Funeral Expense Insurance For Seniors

Final Burial Insurance