All Categories

Featured

Table of Contents

There is no payout if the policy runs out prior to your death or you live beyond the plan term. You might be able to renew a term policy at expiry, yet the premiums will certainly be recalculated based on your age at the time of revival.

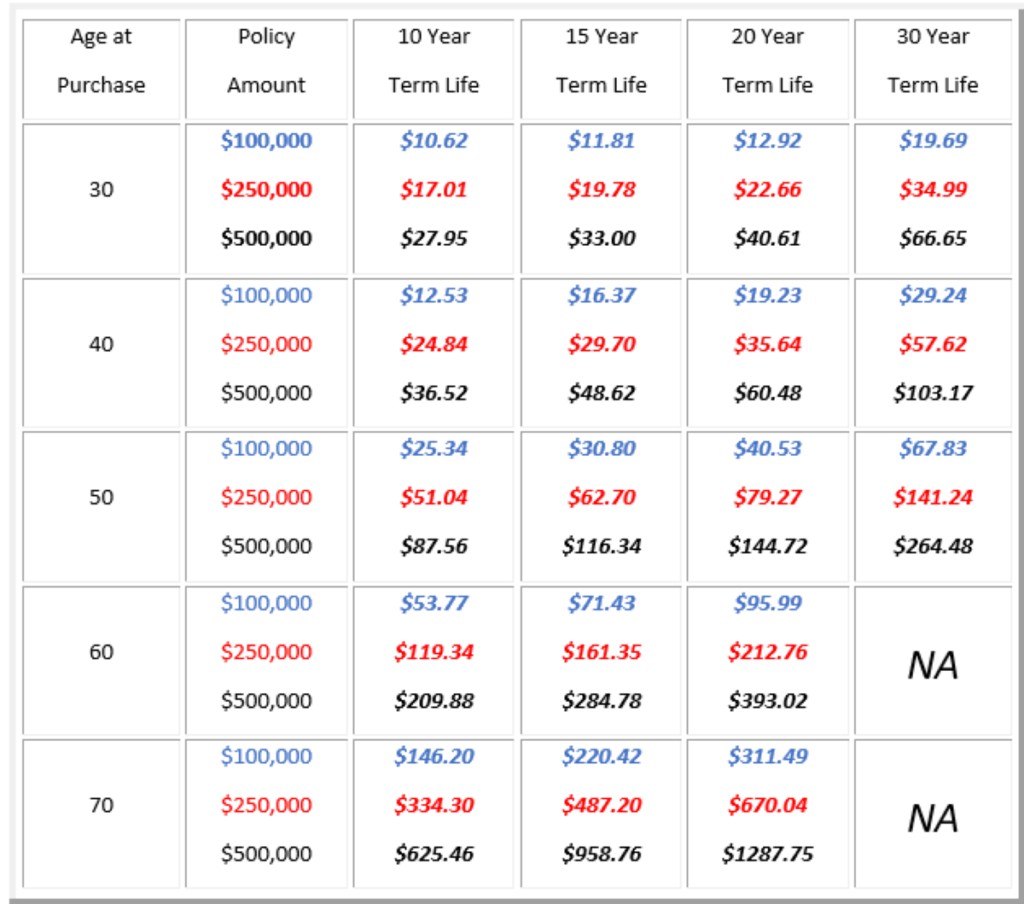

At age 50, the costs would certainly climb to $67 a month. Term Life Insurance Rates thirty years old $18 $15 40 years old $28 $23 half a century old $67 $51 Source: Quotacy. Quotes are for a $250,000 30-year term life plan, for males and females in superb health. In contrast, right here's a consider rates for a $100,000 whole life plan (which is a kind of irreversible plan, indicating it lasts your life time and includes cash money worth).

The minimized threat is one element that permits insurance firms to charge reduced costs. Rates of interest, the financials of the insurance provider, and state laws can additionally affect premiums. Generally, business frequently supply better rates at the "breakpoint" protection degrees of $100,000, $250,000, $500,000, and $1,000,000. When you take into consideration the amount of protection you can get for your costs dollars, term life insurance has a tendency to be the least pricey life insurance.

He acquires a 10-year, $500,000 term life insurance plan with a costs of $50 per month. If George dies within the 10-year term, the plan will pay George's beneficiary $500,000.

If George is diagnosed with a terminal health problem during the very first policy term, he most likely will not be eligible to restore the policy when it expires. Some plans offer guaranteed re-insurability (without proof of insurability), however such features come with a higher price. There are a number of sorts of term life insurance policy.

Most term life insurance has a level premium, and it's the type we've been referring to in many of this article.

Secure Level Term Life Insurance

Term life insurance policy is attractive to youngsters with kids. Moms and dads can acquire considerable insurance coverage for an inexpensive, and if the insured passes away while the plan is in effect, the family can depend on the fatality advantage to replace lost income. These policies are likewise fit for individuals with expanding families.

Term life plans are perfect for people who want substantial coverage at a low expense. People that possess entire life insurance coverage pay extra in costs for less coverage however have the protection of understanding they are shielded for life.

The conversion cyclist need to permit you to transform to any type of permanent plan the insurer provides without constraints. The main attributes of the cyclist are keeping the initial health and wellness ranking of the term policy upon conversion (also if you later on have health and wellness concerns or come to be uninsurable) and making a decision when and just how much of the insurance coverage to convert.

Obviously, total costs will boost considerably because entire life insurance policy is extra costly than term life insurance. The advantage is the assured authorization without a clinical test. Medical problems that develop during the term life duration can not trigger premiums to be increased. The company might need minimal or full underwriting if you desire to include added riders to the brand-new policy, such as a long-term treatment cyclist.

Whole life insurance policy comes with significantly higher regular monthly costs. It is indicated to provide insurance coverage for as lengthy as you live.

Outstanding What Is Voluntary Term Life Insurance

It depends on their age. Insurance policy business established a maximum age restriction for term life insurance coverage policies. This is usually 80 to 90 years of ages yet may be greater or lower depending upon the business. The premium likewise rises with age, so a person aged 60 or 70 will pay considerably greater than a person decades younger.

Term life is somewhat similar to automobile insurance coverage. It's statistically unlikely that you'll need it, and the premiums are cash away if you do not. If the worst happens, your household will receive the benefits.

One of the most popular type is currently 20-year term. Many companies will certainly not offer term insurance to a candidate for a term that ends past his/her 80th birthday celebration. If a policy is "eco-friendly," that implies it proceeds effective for an added term or terms, as much as a defined age, even if the health of the guaranteed (or other variables) would create him or her to be declined if she or he obtained a new life insurance coverage plan.

So, premiums for 5-year eco-friendly term can be level for 5 years, then to a brand-new rate mirroring the new age of the guaranteed, and so on every 5 years. Some longer term policies will certainly guarantee that the costs will certainly not increase throughout the term; others don't make that assurance, enabling the insurance provider to raise the price during the plan's term.

This suggests that the policy's owner has the right to change it into a permanent kind of life insurance policy without extra proof of insurability. In a lot of kinds of term insurance coverage, consisting of property owners and vehicle insurance, if you have not had a claim under the plan by the time it ends, you obtain no refund of the costs.

Renowned Does Term Life Insurance Cover Accidental Death

Some term life insurance policy customers have been unhappy at this end result, so some insurance companies have actually produced term life with a "return of costs" attribute. increasing term life insurance. The premiums for the insurance coverage with this attribute are typically dramatically higher than for policies without it, and they typically call for that you keep the plan active to its term otherwise you waive the return of costs advantage

Level term life insurance policy premiums and death benefits remain consistent throughout the plan term. Degree term life insurance coverage is typically more inexpensive as it doesn't build cash worth.

Expert Does Term Life Insurance Cover Accidental Death

While the names often are used interchangeably, level term protection has some crucial differences: the premium and death advantage stay the very same throughout of coverage. Level term is a life insurance coverage policy where the life insurance policy premium and death benefit stay the very same throughout of insurance coverage.

Latest Posts

National Seniors Insurance Funeral Plan

Funeral Expense Insurance For Seniors

Final Burial Insurance